Understanding & Selecting Managed Account Services - Part A

Managed Accounts have been accelerating in popularity in the past few years with FUM estimated at over $15 billion and there is much industry anticipation that their rate of growth will accelerate further. Despite this increasing popularity and anticipation, general industry knowledge levels around managed accounts are relatively low. In this brief article we provide an overview of what managed accounts are and where different forms of managed account sit in the regulatory framework. We also provide a link to Part A of a more detailed paper we have produced called Understanding & Selecting Managed Accounts.

What exactly is a managed account?

The term “managed account” refers to a particular subset of the discretionary portfolio management services universe that includes managed discretionary accounts (MDAs) and separately managed accounts (SMAs) offered via a product disclosure statement (PDS).

The defining characteristics of Managed Accounts are:

- The investor grants discretion to a third party to manage the portfolio on their behalf, without recourse to the investor when making and implementing investment decisions; and

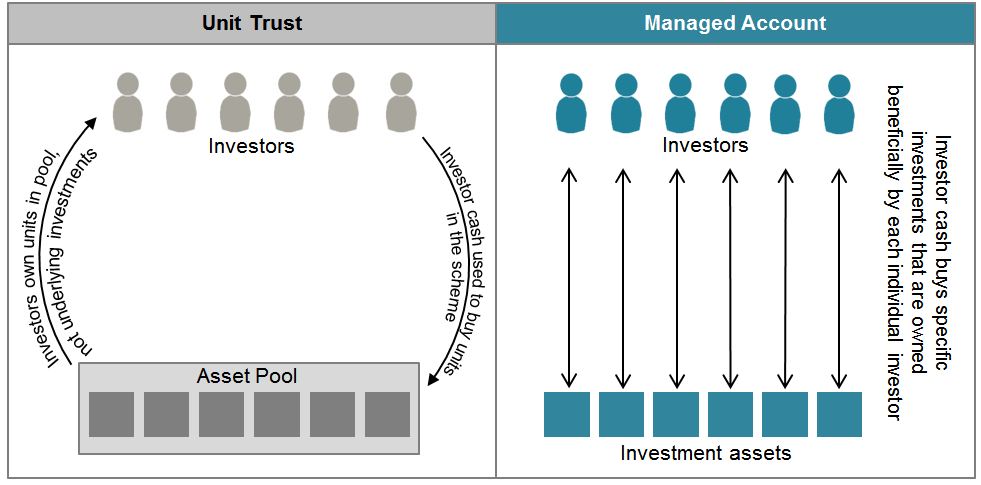

- each investor has direct or beneficial ownership of the individual underlying investments in their portfolio rather than taking a share of a pool of assets via issued units. The investor therefore enjoys the tax advantages that direct ownership offers relative to the unit trust structure[1].

The most common underlying investments held in managed accounts are direct securities, managed funds and bank deposits. The difference between unitised structures used in managed funds and non-unitised structures used in managed accounts is shown conceptually in the diagram below.

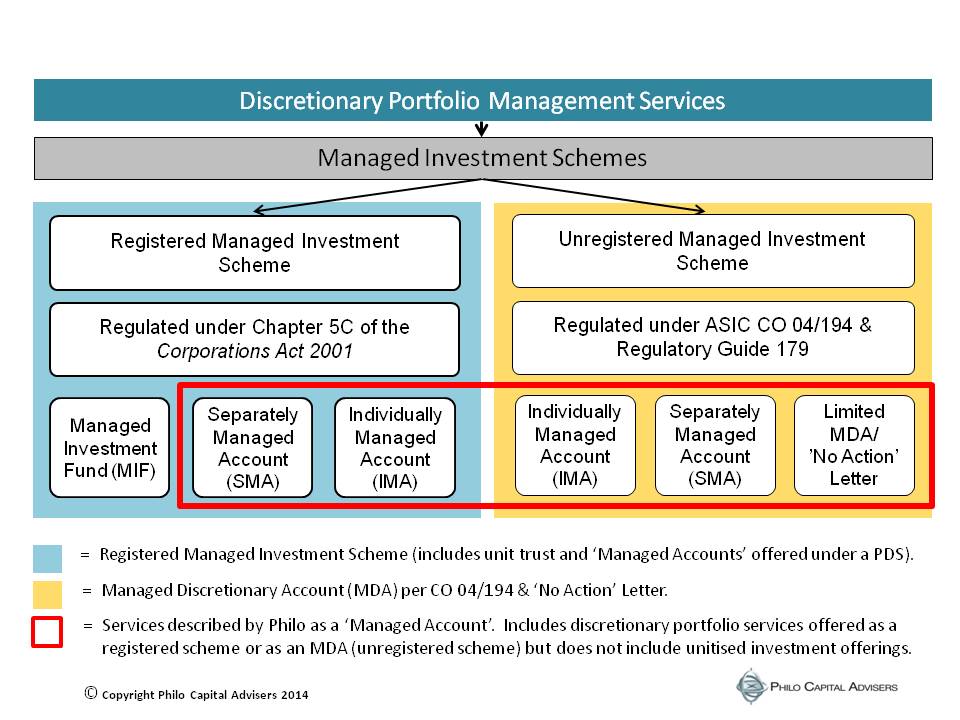

Where managed accounts fit in the universe of discretionary portfolio management services, and the types of managed accounts that exist in the Australian context, is shown in the diagram below.

Within this document when we use the term ‘managed accounts’ we are referring to the structures encapsulated within the solid red line above, unless specifically stated otherwise.

Clarifying managed account terminology

Part of the confusion around managed discretionary accounts is the different terminology that is used, some of which does not have a universally understood meaning. Using the chart above as a reference point, let’s run through a few of the terms that cause confusion.

A managed account is a discretionary portfolio management service that is non-unitised and that provides investors with the tax advantages of beneficial ownership of each individual asset in the portfolio. Managed accounts can be either registered or unregistered schemes.

Managed accounts operated as registered schemes must meet the regulatory requirements of chapter 5C of the Corporations Act, which includes the obligation to issue a PDS.

Managed investment funds (conventional unit trusts) are not managed accounts because they involve unitisation, but we do consider them a form of discretionary portfolio management service as the investor authorises the investment manager to manage the portfolios within a mandate.

Separately Managed Accounts (SMAs) and Individually Managed Accounts (IMAs) can be offered as either registered or unregistered schemes. There are no accepted industry definitions of Separately Managed Account (SMA) and Individually Managed Account (IMA) and the services the terms are applied to can be quite different in nature.

When people refer to a SMA this tends to mean a service that:

- Has little or no customisation ability i.e. generally, everyone owns the same investments in the same proportions

- Is more likely to be, but is not necessarily, a single asset class portfolio

- Is more likely to be a registered scheme under a product disclosure statement (PDS).

At one end of the scale an SMA can look a lot like an Australian equity trust run by a single manager - but with no unit pricing and the stocks held beneficially for the end investor. At the other end of the scale, an SMA could be a multi asset class service where a range of fund managers / managed funds are used to access the different asset classes.

When people refer to an IMA this tends to mean a service that:

- Is generally customised for the individual investor

- Is more likely to be a multi asset class portfolio service

- Is more likely to be offered as a MDA (i.e. no PDS is required)

- Is likely to be more expensive than an SMA from the same provider

The sort of customisation capability an IMA might make available includes:

- Excluding a particular stock or asset class

- Substituting one stock or fund for another

- Holding minimum levels of cash

- Not selling a particular investment without express permission of the client

- Being tax aware in investment decisions

The term “Managed Discretionary Account” (MDA) is only found in Class Order 04/194 and Regulatory Guide 179 which refers to unregistered schemes. The term is not found in the Chapter 5C of the Corporations Act and so we reserve the term Managed Discretionary Account for schemes governed by the class order and use the term Managed Account as a more general term covering registered and unregistered schemes.

Limited MDAs or No Action MDAs are unregistered schemes offered under the relief granted by ASIC in a no action letter issued in 2004. These MDAs are limited to operation on a regulated platform in conjunction with a limited power of attorney. They are typically used to rebalance multi asset class portfolios using the model portfolio functionality on the chosen platform. Please see the later section in part B of this paper on MDAs offered under the no action letter for more information.

MDA regulation applies in the retail market only. i.e. when providing discretionary portfolio management services to wholesale investors Class Order 04 / 194 and Regulatory Guide 179 do not apply.

[1] When an investor buys units in a trust the unit price generally contains components of accumulated income and realised capital gains. This turns part of the new investor’s capital into taxable income and gains. ON an ongoing basis, where the unit trust manager sells investments to fund redemptions, this can also generate taxable gains for the investor that is not leaving the unit trust.

For more information

If you would like to further develop your knowledge of managed accounts you may like to read our more detailed paper entitled Understanding & Selecting Managed Accounts – Part A, a copy of which can be obtained from the Philo website by clicking here.

Copyright

© Copyright: Philo Capital Advisers Pty Ltd 2014. No part of this publication may be reproduced by any process without prior written permission of the authors.

Disclaimer

This article has been prepared by Philo Capital Advisers Pty Ltd ABN 70 119 185 974 AFSL 301808 (Philo) and contains general investment advice only. The information in this article does not take account of your objectives, financial situation or needs or those of your client. Before acting on this information readers should consider whether it is appropriate to their situation. We recommend obtaining financial, legal and taxation advice before making any financial investment decision. To the extent permitted by law, neither Philo nor any of its related entities accepts any responsibility for errors or misstatements of any nature, irrespective of how these may arise, nor will it be liable for any loss or damage suffered as a result of any reliance on the information included in this article. The information in this article is based on information obtained from sources believed to be reliable and accurate at the time of publication but we do not make any representation or warranty that it is accurate, complete or up to date. We accept no obligation to correct or update the information or opinions in it. Opinions expressed are subject to change without notice. Past performance is not a reliable indicator of future performance. Any forecasts included in this article are predictive in character and may be affected by incorrect assumptions or by known or unknown risks and uncertainties. Nothing in this article shall be construed as a solicitation to make a financial investment.